The Largest Credit Rating Agency with a 28-Year History

GRI 2-6

Our mission is to be a confidence institution that links together the businesses, the government and the society by providing expertise for decision-making.

Expert RA:

- Founded in 1997

- Currently Russia’s oldest and largest credit rating agency by both customer base and number of employees

- Assigning credit ratings has been Expert RA’s core business for 28 years

- Expert RA is not only a market leader in credit rating services but also a high-profile analytical center in Russia

Expert RA is an essential part of the financial market infrastructure

Stock Market and Lending

Being rated by Expert RA is among the official requirements imposed on banks, insurers, pension funds, and issuers. Expert RA’s ratings are used by the Bank of Russia, Ministry of Finance of the Russian Federation and Ministry of Economic Development of the Russian Federation, Moscow Exchange (MOEX), and by hundreds of corporates and government agencies in their tender and bidding processes, as well as millions of investors.

Sustainable Development

Expert RA is in the Bank of Russia’s Register of Credit Rating Agencies and is also listed as an independent verifier of green and social bonds by the International Capital Market Association (ICMA)ICMA suspended the membership of Russian participants on 1 March 2022., MOEX and VEB.RF.

Expert RA is Russia’s market leader in credit rating services

At year-end 2024, Russian credit rating agencies (CRAs) rated 884 entities, 529 of which were covered by Expert RA. According to the Bank of Russia, Expert RA accounts for more than 50% of ratings assigned in the Russian credit rating market.

Our Values and Advantages

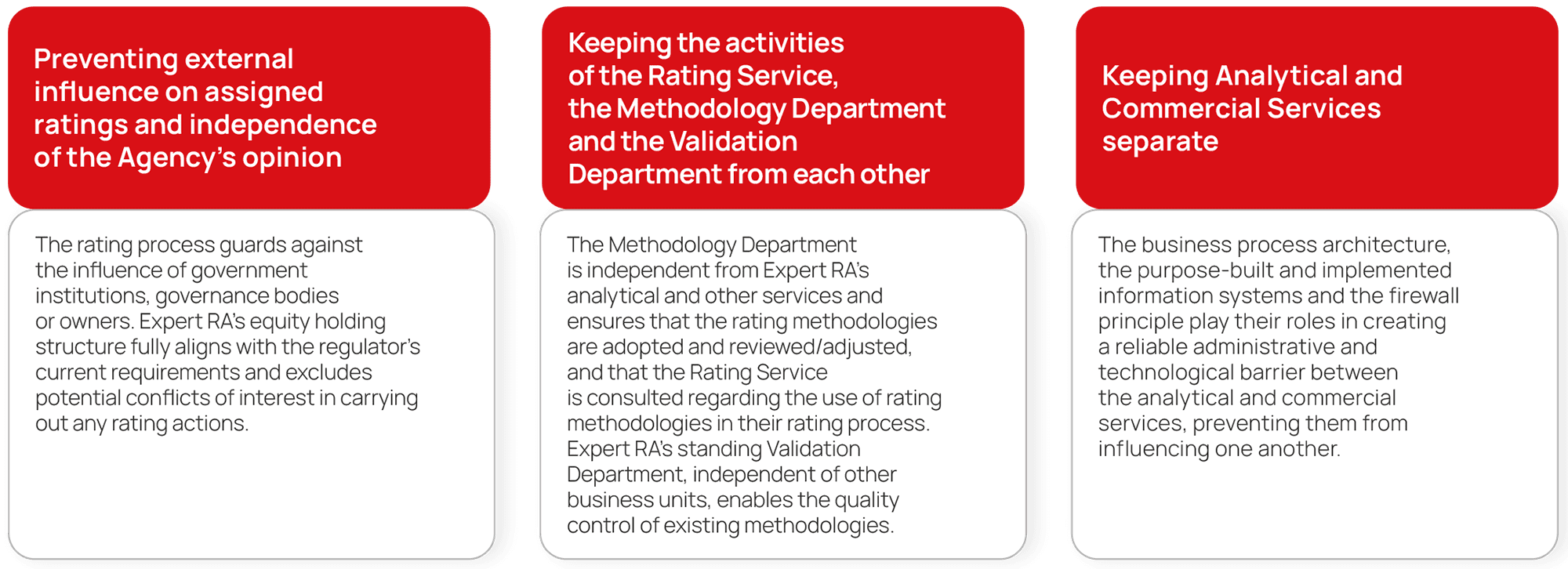

Adherence to the Principle of Independence: Free from External and Internal Influences

Our Agency is completely independent in its assessments.

Expert RA makes sure that its rating activities are strictly in line with the requirements of the federal legislation and international regulatory best practices.

Regulatory Use of Ratings: Obtaining Financing

At year-end 2024, there were 77 statutory acts requiring the use of Expert RA’s credit ratings for regulatory purposes

Debt instruments | 489 | ▲117 |

Non-financial companiesIncluding the Republic of Belarus. | 202 | ▲26 |

BanksIncluding the Republic of Belarus. | 145 | ▲3 |

All-lines insurers | 51 | ● |

Leasing companies | 30 | ▲2 |

Constituent entities of RF and municipalities | 28 | ▲1 |

Holding companies | 16 | ▲2 |

Financial companies | 16 | ▲3 |

Microfinance institutionsIncluding the Republic of Kazakhstan. | 15 | ● |

Non-government pension funds | 11 | ▼1 |

Project companies | 3 | ▼2 |

Factoring companies | 7 | ▲2 |

Depositories | 2 | ● |

Source of information: rating list of Expert RA as of 31 December 2024

ruAAA |

|

ruAA |

|

ruA+ |

|

ruA– |

|

ruBBB+ |

|

ruBB+ |

|

ruBB |

|

ruB– |

|

To see the full list of statutory documents regulating the use of ratings, click here.

Rating Methodologies

The Agency has 44 active methodologies (29 credit rating and 15 non-credit rating ones).

We have developed and are using a separate ESG rating methodology and 12 original methodologies in the area of sustainable development.

ESG Leadership: Ambassador of Sustainable Agenda in Russia

Expert RA operates in accordance with:

- UN Sustainable Development Standards

- ICMA’s Sustainability-Linked Bond Principles; LMA’s Sustainability-Linked Loan Principles

- Russian Federation Government’s Decree No. 1587 On Endorsing the Criteria for Sustainable (Including Green) Development Projects in the Russian Federation and Requirements for Verifying Sustainable (Including Green) Development Projects in the Russian Federation dated 21 September 2021

- Regulation of the Bank of Russia No. 706-P On the Standards for Issuing Securities dated 19 December 2019

Expert RA is recognised as a verifier for conducting independent assessments of sustainable financing instruments:

- Moscow Exchange (MOEX)

- Kazakhstan Stock Exchange (KASE)

- Kyrgyz Stock Exchange (KSE)

Expert RA’s growing ESG portfolio

Indicator | 2022 | 2023 | 2024 |

|---|---|---|---|

ESG ratings | 12 | 19 | 27 |

Green bonds | 12 | 13 | 13 |

Social bonds | 11 | 12 | 15 |

Adaptation (transition) bonds | 1 | 1 | 1 |

Social concepts | – | 1 | – |

Financial instruments for sustainable development | – | – | 1Independent opinion on the compliance of digital financial assets with the principles of sustainable development. |

Governance Quality Rating | 5 | 5 | 5 |